Find your new home

We have helpful tools and advice to help with the process of buying your new Linden Home.

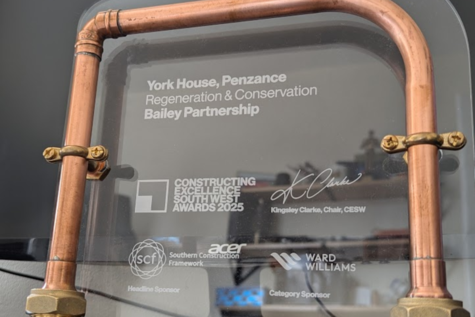

Linden Homes builds award-winning homes across the country in prime locations, striving to create sustainable new developments.

We work with local people to create communities and we’re passionate about building the right homes for our customers.

Our helpful home guides are full of useful tips and information for our existing customers.

Find your new home

We have helpful tools and advice to help with the process of buying your new Linden Home.

Linden Homes builds award-winning homes across the country in prime locations, striving to create sustainable new developments.

We work with local people to create communities and we’re passionate about building the right homes for our customers.

Our helpful home guides are full of useful tips and information for our existing customers.